- Analytics

- Technical Analysis

WHEAT Technical Analysis - WHEAT Trading: 2016-07-27

Weather affects grain crop

Wheat prices declined by 20% over the last 8 weeks and have recently updated a 10-year minimum. Farmers of almost all countries express dissatisfaction with low prices. Australian farmers have decided to reduce sales and they are going to build a number of granaries in the hope that the prices will rise in the future. Will this contribute to the increase in wheat prices?

Cooperative Bulk Handling, the largest Australian grain exporter, said that it is expecting a record grain harvest of 16 million tons this year and it is going to build granaries considering the current prices underestimated. The total wheat crop in Australia may exceed the official forecast of 25, 4 million tons. Theoretically, the rest of farmers may join this cooperative. The decision to hold of selling grains is based on the assumption that La Niña hurricane can develop in the Pacific Ocean. It can strongly damage agriculture.

According to the American state meteorological agency Climate Prediction Center, there is now a 55-60% chance that La Niña will develop. It develops in August-October. There is not much time left, therefore weather forecasts will be refined in the coming weeks. They can have a significant impact on wheat prices and other agricultural futures.

Last week, some European agricultural agencies stated that because of the bad weather, wheat crop in France may be the lowest for the last 13 years. In addition, grain production forecasts were reduced in other EU countries as well. Brazilian agency Cepea reported about the completion of corn planting in the country. It noted that there remains a risk of damage of part of the crops in Paraná state in southern Brazil due to drought.

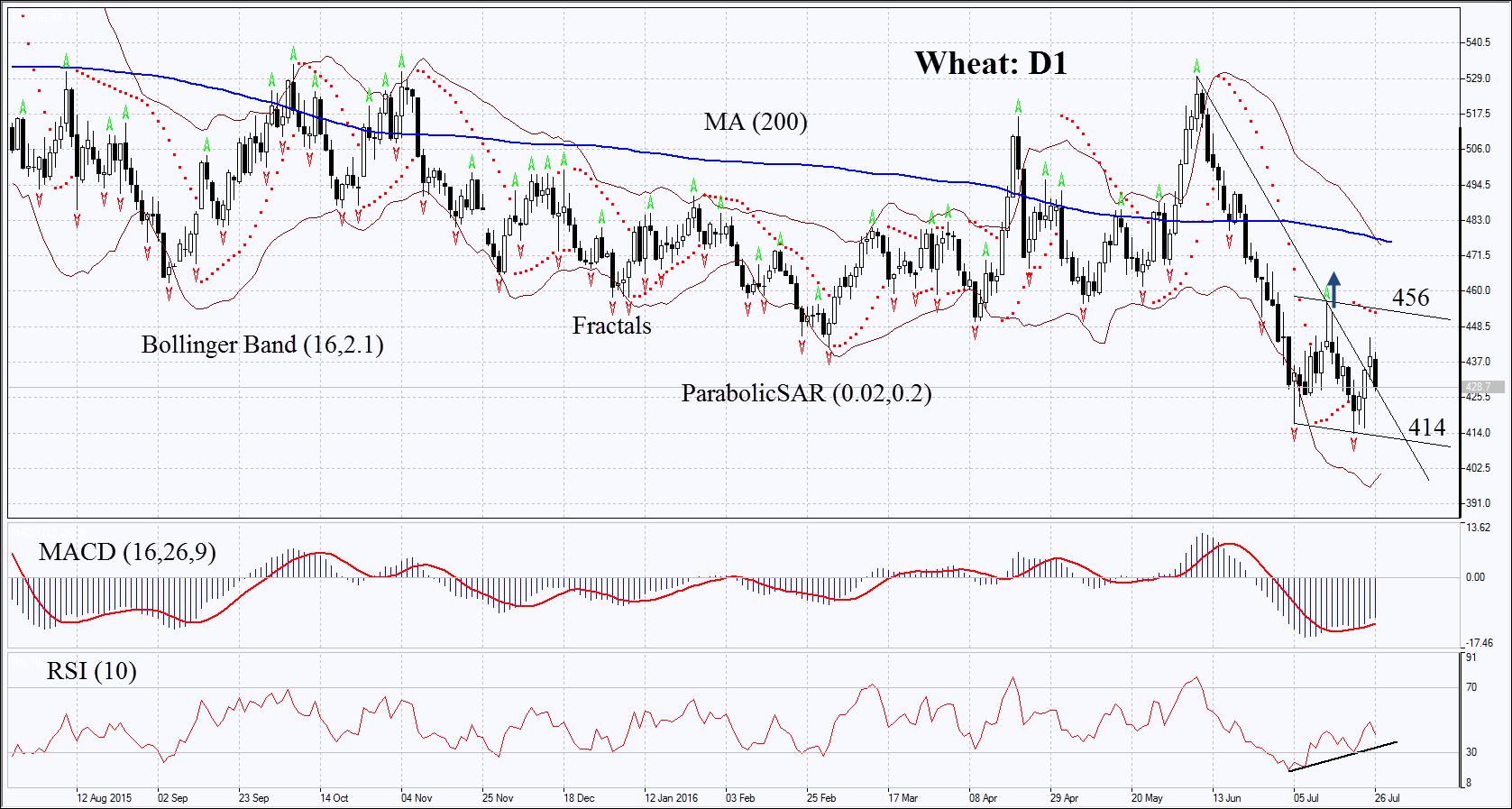

On the daily chart, Wheat: D1 suspended the drop after the renewal of a 10-year maximum and even slightly increased. The MACD indicator has formed the signal to buy. The Parabolic indicator still indicates sale, but its signal may serve as an additional level of resistance that must be overcome. The Bollinger bands have widen significantly which means high volatility. The RSI indicator is in the rising trend and below 50. It has formed positive divergence. The bullish momentum may develop in case wheat exceeds the last fractal high and Parabolic signal at 456. This level may serve as a point of entry. The initial stop-loss may be placed below a 10-year minimum at 414. After opening the pending order we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 414 without reaching the order at 456, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Buy |

| Buy stop | above 456 |

| Stop loss | below 414 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.