- Analytics

- Market Overview

US stocks slide as technology selloff resumes - 30.6.2017

Volatility in technology stocks jumps

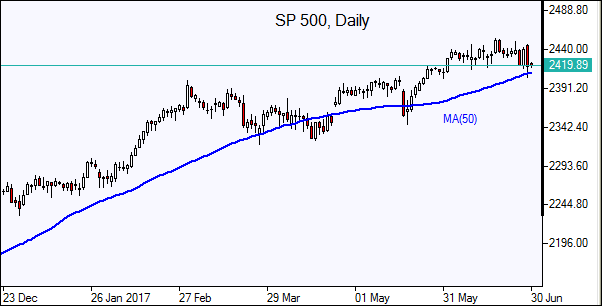

US stocks slumped on Thursday with losses in technology shares offsetting gains in financial sector as the selloff of tech stocks resumed. The dollar tumbled: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended 1% lower at 95.568. Dow Jones industrial average lost 0.8% closing at 21287.03. The S&P 500 fell 0.9% settling at 2419.70. The Nasdaq index slumped 1.4% to 6144.35 after a 1.4% gain on Wednesday.

The technology sector is experiencing a jump in volatility driven by concerns that large-cap technology stock valuations are overstretched. Financial sector posted 0.7% gains after 34 biggest US banks passed the Federal Reserve’s stress test, with the Fed saying the country’s biggest banks have “strong” levels of capital and would be able to keep lending even during a severe recession. Bank shares were helped also by a rise in Treasury yields. The upgrade of the Q1 GDP to 1.4% from the second estimate of 1.2% didn’t lift the sentiment sufficiently to turn the direction of trades.

European stocks pressured by stronger euro

European stock indices fell sharply on Thursday as concerns about impending start of policy tightening weighed on market sentiment. The euro and British Pound extended gains against the dollar. The Stoxx Europe 600 tumbled 1.3%. Germany’s DAX 30 fell 1.8% closing at 12416.19. France’s CAC 40 sank 1.9% while UK’s FTSE 100 ended 0.5% lower at 7350.32. Indices opened lower today.

The euro and Pound advanced as investors price in the possibility of the central banks’ shift to tightening stance sooner than previously expected after hawkish comments by ECB and Bank of England heads Draghi and Carney. In the UK the Bank of England Governor Carney suggested on Wednesday that there’s a limit to the BOE’s tolerance for above-target inflation. Stronger currencies weighed on exporter stocks as they make products more expensive in export markets, negatively impacting earnings prospects. Higher German inflation report also supported the euro: consumer prices rose at an annualized 1.6% in June, from 1.5% in May. European Commission’s economic-condition sentiment indicator also came in better than expected.

Asian markets mixed

Asian stock indices are mostly down today as investor confidence was undermined by US Senate decision to delay the health care reform vote and technology stocks fell tracking Wall Street overnight. Nikkei fell 0.5% to 20130.41 despite a weaker yen against the dollar. Bank stocks posted gains though as Yellen’s comments supporting gradual rate hikes in US raised their earning prospects expectations. Chinese stocks are down: the Shanghai Composite Index is 0.5% lower and Hong Kong’s Hang Seng Index is down 0.6%. Australia’s All Ordinaries Index is up 0.8% despite stronger Australian dollar against the greenback.

Oil advances on US output decline

Oil futures prices are edging higher underpinned by a decline in US output. US crude output fell 100,000 barrels per day (bpd) to 9.25 million bpd last week, the steepest weekly fall since July 2016. Prices recovered yesterday from seven-month lows helped by a second weekly draw in US crude inventories. Brent for August settlement climbed 0.2% to end the session at $47.42 a barrel on the London-based ICE Futures Europe exchange on Thursday.

News

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also