- Analytics

- Market Overview

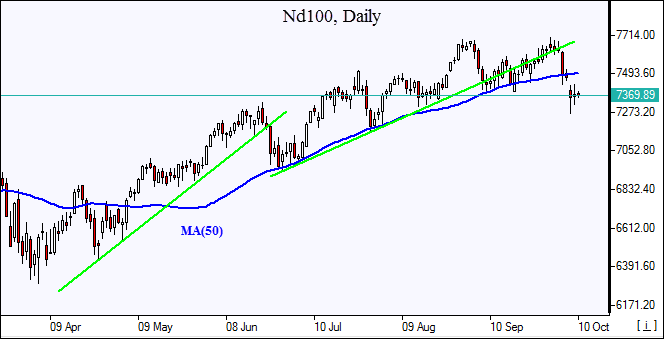

SP500 logs fourth consecutive decline while Nasdaq edges up - 10.10.2018

Dollar reverses course lower

US stock market retreat continued on Tuesday while the Nasdaq edged higher as technology stocks recovered. The S&P 500 slipped 0.1% to 2880.34. Dow Jones erased previous session gain ending 0.2% lower at 26430.57. The Nasdaq composite index added 0.03% to 7738.02. The dollar strengthening reversed as 10-year Treasury yields dipped after hitting a fresh 7-year high above 3.25%: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.1% to 95.663 and is lower currently. Futures on stock indices indicate mixed openings today.

European indices open lower

European stocks rebounded on Tuesday as Italian bond yields rise paused after Economy Minister Giovanni Tria said "the government will do what it needs to do, as (European Central Bank president) Draghi did" if risks of financial crisis due to Italy’s high budget deficit increased. The GBP/USD turned higher on reports EU and UK negotiators moved closer to Brexit deal. The EUR/USD ended flat. Both pairs are rising currently. The Stoxx Europe 600 added 0.2%. The German DAX 30 rose 0.3% to 11977.22. France’s CAC 40 advanced 0.4% and UK’s FTSE 100 gained 0.1% to 7237.59. Markets opened lower today.

Asian indices recover

Asian stock indices are higher today. Nikkei ended 0.2% higher at 23506.04 helped by resumed yen slide against the dollar. Chinese stocks are higher despite Presient Trump’s repeated threat to impose tariffs on additional $267 billion worth of Chinese imports if Beijing retaliates to last month’s tariffs on nearly $200 billion of imports from China: the Shanghai Composite Index is up 0.2% and Hong Kong’s Hang Seng index is 0.5% higher. Australia’s All Ordinaries Index rebounded 0.1% despite Australian dollar continued slide against the greenback.

Brent edges up

Brent futures prices rebound continues today. Prices advanced yesterday on signs global supply tightened ahead of US sanctions on Iran: Iran exported only 1.1 million barrels a day of crude in the first week of October, after 1.6 million barrels a day in September. Prices ended higher yesterday: December Brent rose 1.3% to $85 a barrel Tuesday.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also