- Analytics

- Market Overview

Dollar Targets at 2012 High; Euro under Pressure - 18.5.2012

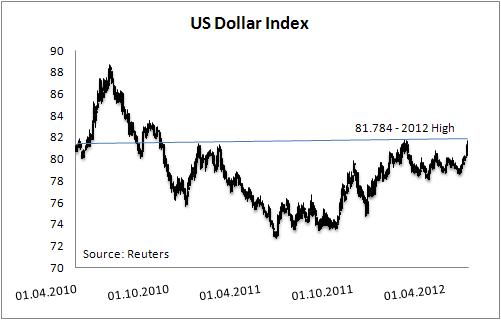

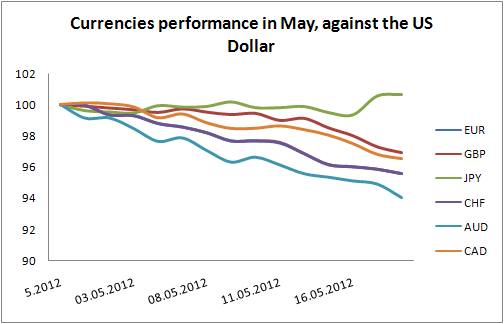

The US dollar on the other hand is accelerating gains against the majors, but the Japanese yen, lifting the dollar’s index, used by Intercontinental Exchange, toward the 2012 high at 81.784. By the end of the Asian trading session the Aussie dropped versus the US counterpart to the lowest since 25 of November 2011 - 0.9794, the British pound weakened to a two-month low of 1.5732. The greenback also strengthened against its northern counterpart, the loonie, to 1.0226, and to 0.9490 versus the Swiss franc – both values are the highest since January. Probably the only major currency outperforming the dollar in May is the Japanese yen. Pair USD/JPY fell yesterday evening to a three-month low of 79.13, having lost almost 0.7% from the beginning of May. The worst performer is the Australian dollar, which has lost almost 6% versus the greenback in May.

News

Hormuz Bottleneck

The Strait of Hormuz, just 21 miles wide at its narrowest point, is currently closed. Through this corridor flows roughly...

Iran Secret Overture to the CIA

A day after US and Israeli strikes began raining down on Iranian territory, operatives from Iran Ministry of Intelligence...

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't translate to vulnerability The Stockpile Advantage - the 1.13-2M...

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also