- Analytics

- Market Overview

The U.S.Dollar Index showed good growth thanks to the weakening of the Euro - 14.5.2014

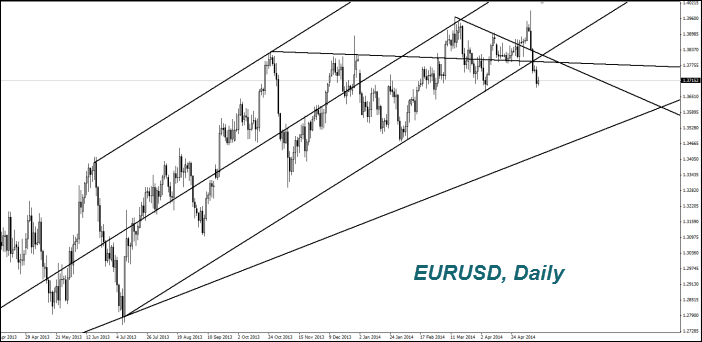

The U.S. retail sales for April rose on Tuesday for a third time in a row, but far less than expected. Overall, yesterday's U.S. economic data were neutral. Nevertheless, the U.S. Dollar index (USDIDX) showed good growth thanks to the weakening of the Euro (EURUSD).

The Economic Activity Index in Germany from the German Centre for European economic Research (ZEW) fell in May for the fifth consecutive month to 1.5-year minimum and amounted to 33.1 points . This is far below the April level at 43.2 points and the forecasts at 41 points. Due to such negativity, the Euro collapsed to a minimum vs. the U.S. Dollar within 5 weeks, the British Pound - within 16 weeks and the Australian Dollar – within 6 months. An additional factor of weakening the single European currency was the statement of the Bundesbank 's readiness to support the ECB decision to start lowering the rates and monetary emission, probably at the next meeting on June 5. (According to the Wall Street Journal report).

Today at 12-30 CET, we will see PPI for April coming out in the U.S.. In our opinion, the preliminary forecast is neutral. The good on inflation in individual countries of the EU came out in the morning. This caused a slight strengthening of the Euro. At 9-00 CET, we will see the Eurozone industrial production index for March. We believe that the preliminary forecast is negative.

Today we expect the UK unemployment data for March coming out at 8-30 CET and the quarterly Inflation Report from the Bank of England at 9-30. In previous reports, we have noted that it is impossible for the Pound (GBPUSD) to overcome the level of $1.7 before this important macroeconomic information appears. It is difficult to say anything about further behavior of the British currency. It is strengthened this morning, as the preliminary forecasts were positive. Note that the yield spread between 10-year government bonds of Germany and England peaked in August 1998, when the Euro appeared. In our point of view, this suggests that investors expect the interest rates to be raised in the UK. It supports the GBP. Earlier, the Bank of England announced a possible increase in interest rates in the case of inflation decrease less than 7%. It has been at 0.5% since March 2009.

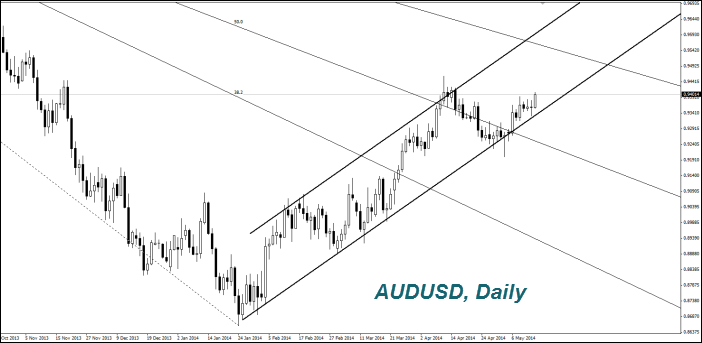

The Australian Dollar (AUDUSD) got stronger (increase on the chart) due to announcement of the Government spending cut. Recall that tomorrow night at 0-30 CET we will see the Australian inflation forecast for May, the car sales data for April, as well as on the governmental financial transactions. Note that the next economic information appears only after on May 21.

We expect the (Q1) Japanese GDP to come out tonight at 23-50 CET. In our opinion, the preliminary forecast is positive. The Japanese Yen (USDJPY) is getting stronger now. It looks like a slight decrease on the chart.

The Sugar price rose strongly after forecasting from Copersucar, the world's largest sugar trader. It expects the sugar deficit on the world market at a rate of 3.2 million tons from 1 October due to its production shortage in Brazil. First of all, it may occur due to the negative impact of drought and the El Nino cyclone. In addition, farmers have responded to the fall in world sugar prices in January to a minimum of three and a half years, with the crops reduction. The Platts Kingsman Agency expects a more modest deficit of sugar in the next season in the amount of 239 000 tons. Recall that it is experiencing an excess of about 4.4 million tons on the world market this year. However, this factor is taken into account in the Copersucar data. According to the trader, the new season sugar harvest in Brazil will be 570 million tons against 596 million tons for the current season.

As we anticipated in yesterday's review, the good growth was shown by the Oil and the Copper. The movement was supported by the less important information. The Oil reserves in the Cushing American repository in Oklahoma tumbled to the lowest level of the year 2008. The largest copper smelting company in Europe (Aurubis) expects a significant improvement of its financial performance for the year.

News

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also