- Analytics

- Market Overview

There were no significant economic events in Forex market yesterday - 13.5.2014

There were no significant economic events in Forex market yesterday. The U.S. Dollar index (USDIDX) was in the neutral trend. Today, we will see the important retail sales data for April coming out in the United States at 12-30 CET. According to the preliminary estimates, they may increase for the third consecutive time. Then it will be a positive factor for the U.S. Dollar. Besides, there will be the information regarding the export and import prices appeared for April and inventories for March. The forecast for these indicators is neutral.

The strong U.S. data boosts investor confidence about possible discount rate increase by the Fed next year for the first time since 2006. It is good for the U.S. Dollar. Accordingly, the Euro (EURUSD) is currently trading near its lowest level of the month. Its downfall began after the ECB announcement of the possible monetary policy easing on May 8. Today at 9:00 CET we will see the economic activity indexes in Germany and the EU for May from ZEW. The forecast is neutral.

The Australian Dollar (AUDUSD) decreased slightly after the negative information about the decrease in the number of mortgage loans in March, for the first time of this year. Note that today the Australian Prime Minister, Tony Abbott, will present the budget for the current year. Its parameters can affect the exchange rate, depending on how and how much the budget deficit decrease will be. The projected deficit for the next fiscal year is A $30B from A $46 B this year.

The U.S. Department of Agriculture (USDA) announced about planting 59% of the area under maize (Corn) and 20% for soybean (Soyb) on May 11 in the United States. Consumers expect the crops to be amounted to 55% and 17%, respectively. The more successful crop in the United States caused a slight decline in prices for agricultural futures.

The (Wheat) prise has risen since the USDA lowered the quality level of its crops "good to excellent" by 1% to 30% for the week. The lowest level since 1996.

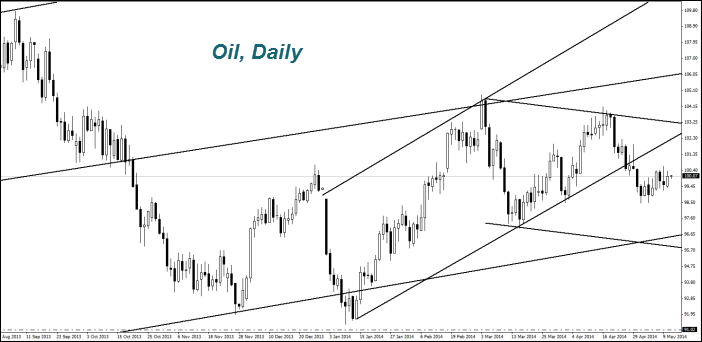

The American (Oil) prices got back to the level around $100 per barrel after a slight decline. According to the forecasts its reserves will be reduced by 1 million barrels to 396.6 million during the week for the first time within five weeks. The official figures will be released tomorrow. The Oil prices got higher also due to the information about Chinese industrial production growth in April by 8.7% compared to April of last year. China consumed 9.7 million barrels per day, or 11% of the world production last month. This is 1.1% above the last year's level. The U.S. consumes twice as much (21% of world production). Investors believe that the Oil demand in China will be closer to the U.S. demand. This contributes to the higher prices. An additional factor was the fear that Western sanctions could have a negative impact on the Russian Oil exports.

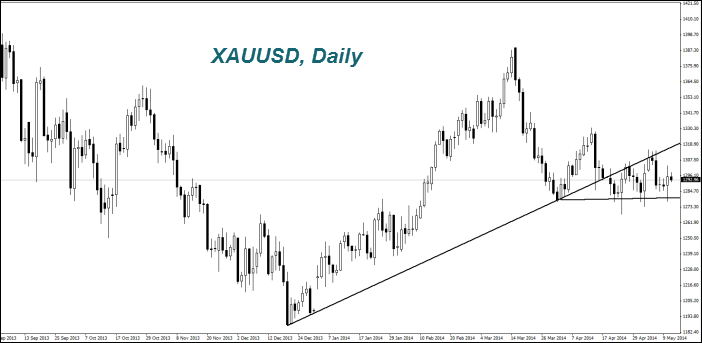

The Gold price (XAUUSD) entered the neutral trend on the strong U.S. economic data and the stronger U.S. Dollar. Note that investors consider the Gold as an alternative to the U.S. assets, such as bonds and equities. An additional factor of the price reduction was a major message from the SPDR Gold Trust fund about the outflow volume of 2.39 tons of gold from its assets amounting to 780.46 tons, for the first time since May 2.

The (Copper) prise rose after the Chinese company, Guangdong Rising Assets Management, offered $1 billion for the Australian copper producer, PanAust.

News

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also