- Analytics

- Market Overview

The main event of the day will be the Fed Chairman’s speech - 16.4.2014

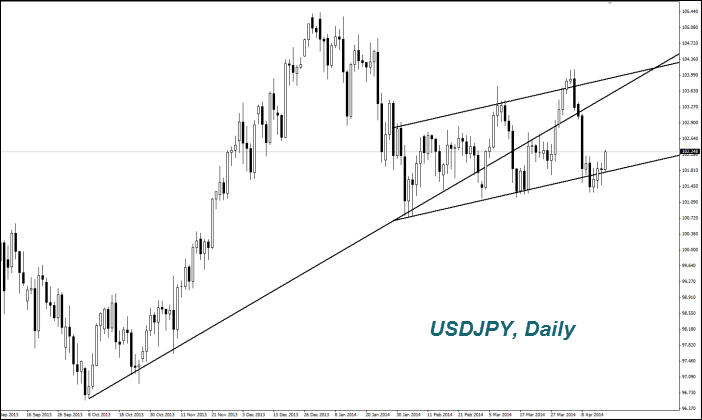

The Japanese Yen (USDJPY) weakened (grown on the chart) since investors consider it as a safe heaven in case of economic negative in China that was not observed yesterday. The morning industrial production data were weak. In addition, the Finance Minister, Taro Azo suggested that the state pension investment fund (GPIF) with assets of $1.26 trn. should purchase more shares of Japanese companies. After that, the Nikkei index rose 2.4%, while the Yen weakened despite the fact that the share purchasing may not start before June. Note that tomorrow morning we expect another portion of statistics and the speech by the head of the Bank of Japan.

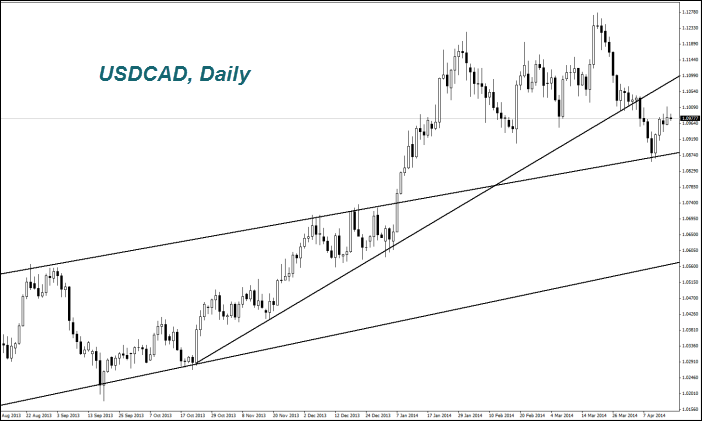

Today at 15:00 CET, there will be the Bank of Canada meeting held. It is expected that the discount rate will remain at the current level of 1%. Market participants will be focused on the final press conference, where the forecasts for the Canadian economy are expected to be presented.

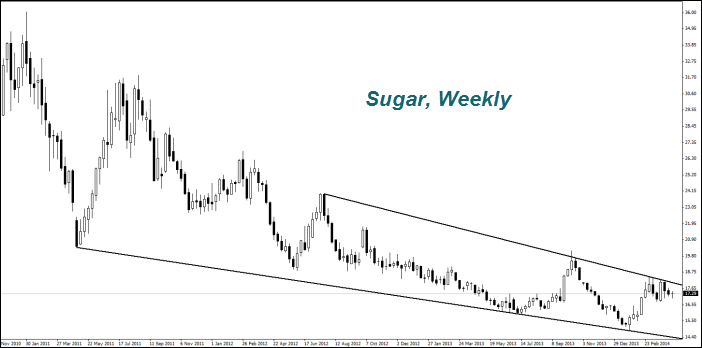

The domestic Sugar prices in India unexpectedly soared to a maximum of 14.5 months. The Indian Association of Sugar Producers lowered its forecast for sugar exports from the country in the season 2014/2015 to 1.8 million tons from 2 million tons. India is the second sugar producer in the world after Brazil and the first sugar consumer. The domestic prices are usually increased with the beginning of the summer season due to increased consumption of ice cream and soft drinks. This year the Sugar prices are likely to be limited due to the presidential elections which are to be held in May. There is $5B planed to be spent for that event. We believe that the demand from India can also provide some kind of support for the world Sugar prices till the end of May.

News

Hormuz Bottleneck

The Strait of Hormuz, just 21 miles wide at its narrowest point, is currently closed. Through this corridor flows roughly...

Iran Secret Overture to the CIA

A day after US and Israeli strikes began raining down on Iranian territory, operatives from Iran Ministry of Intelligence...

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't translate to vulnerability The Stockpile Advantage - the 1.13-2M...

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also