- Analytics

- Market Overview

Last week US stocks and dollar fell both - 2.5.2016

European stock indices are edging lower higher after their weekly fall. The Manufacturing PMI for April rose in Eurozone. In Germany it is edging up for the third month. This week 65 companies from STOXX 600 index will release their Q1 2016 earnings including such giants as Lloyds, Royal Bank of Scotland, Shell, Continental, HSBC Holdings, BMW and UBS Group. 43% of European companies reported their earnings so far. In 62% cases the earnings were above the estimates but STOXX 600 is still 6.4% below the openings of the year. Today in Great Britain are the banking holidays so the trading volume in the exchanges is low and about 60% of the recent 30 days average. Now STOXX 600 is traded the Р/Е of 15 which is 17% above the average for the recent 5 years.

Nikkei continued edging lower on Monday amid yen strengthening of 13% since the start of the year. The exporters stocks fell: Toyota Motor (-3,8%), Nissan Motor(-5%) and Honda Motor (-4%). Meanwhile, market participants expect the Bank of Japan to intervene to weaken the national currency. In such a case Nikkei is likely to correct upwards so its stocks are falling less than previous week. The slight increase in Manufacturing PMI for April also supported the stocks. On the other hand, Sony Corp stocks lost 4% and Panasonic Corp lost 7.4% on weak earnings. This week there are three holidays in Japan since Tuesday so the stock exchanges will be closed.

On Sunday the Manufacturing PMI for April came out in China being below the forecasts which limited growth of commodity futures. Chinese and Hong-Kong stock exchanges are closed on Monday due to the holiday. The commodities increase in April was at record high since 2010.

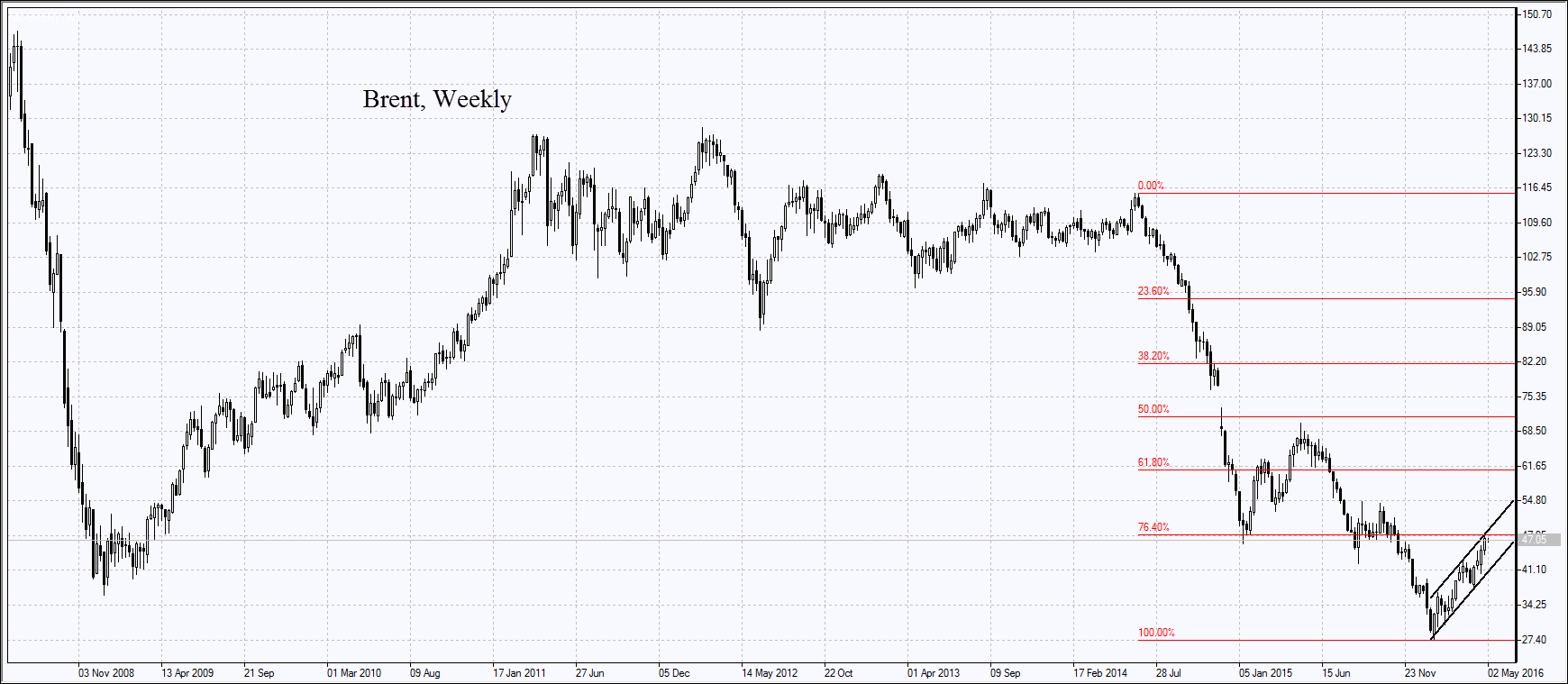

Oil prices were edging lower on Monday for the second straight day from the year-high hit on Friday. This happened on the news the OPEC production volumes came close to the historical high in April amounting to 32.64mln barrels a day.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account