- تحليلات

- أكثر الرابحين / الخاسرين

Top Gainers and Losers: British Pound and Mexican Peso

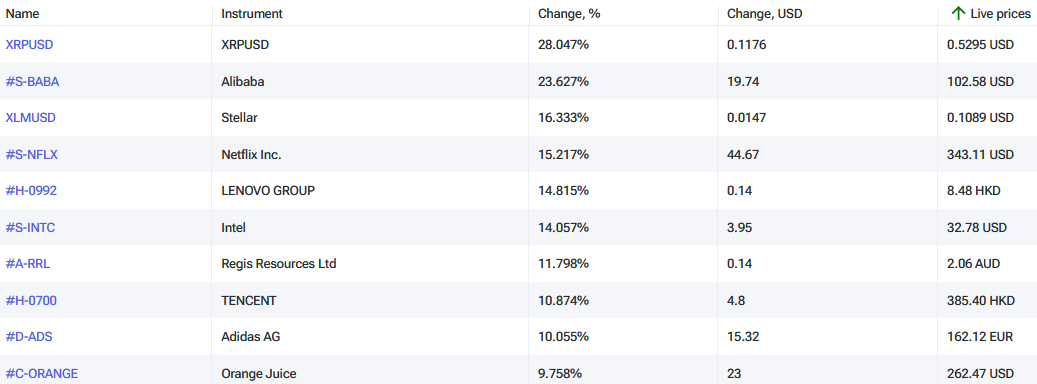

Top Gainers - global market

Top Gainers - global market

Over the past 7 days, the US dollar index continued to decline but failed to update the previous week's minimum. A slowdown in the decline can be noted. Preliminary data for the first quarter of 2023 showed that the US dollar index fell by -1.3%. In the fourth quarter of 2022, its decline was much greater and amounted to -7.7%. The strengthening of the Mexican peso was due to the Bank of Mexico raising its rate from 11% to 11.25%. This happened despite a decrease in Mexican inflation in February to +7.62% y/y, the lowest level since March 2022. The strengthening of the South African rand was due to the South African Reserve Bank raising its rate from 7.25% to 7.75%. This level is higher than South African inflation in February, which was +7% y/y. The strengthening of the British pound was due to UK GDP growth in the fourth quarter of 2022, which was +0.6% y/y. This was better than expected (+0.4%). The Japanese yen weakened against the backdrop of the risks of high inflation. In March, the Tokyo Consumer Price Index grew by +3.3% y/y, higher than expected (+2.7%).

1. XRPUSD, +28% – Cryptocurrency Ripple (XRP)

2. Alibaba Group, +23.6% – Chinese online store

Top Losers - global market

Top Losers - global market

1. VIX Index – CFD on CBOE Volatility Index

2. Fosun International Limited – Hong Kong multi profile holding.

Top Gainers - foreign exchange market (Forex)

Top Gainers - foreign exchange market (Forex)

1. CADJPY, NZDJPY - the growth of these charts means the strengthening of the Canadian and New Zealand dollars against the Japanese yen.

2. GBPJPY, GBPSEK - the growth of these charts means the weakening of the Japanese yen and the Swedish krona against the British pound.

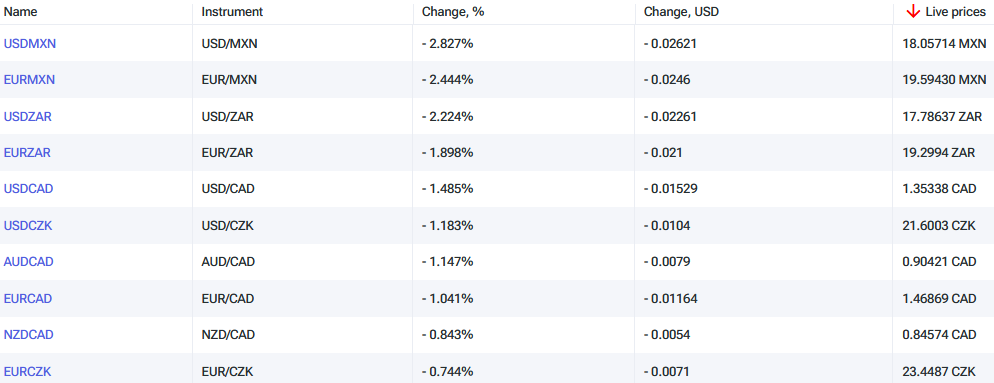

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. USDMXN, EURMXN - the decline of these charts means the weakening of the US dollar and the euro against the Mexican peso.

2. USDZAR, EURZAR - the decline of these charts means the strengthening of the South African rand against the US dollar and the euro.

أداة حصرية جديدة للتحليل

ا يوجد نطاق زمني محدد – من يوم إلى سنة

أي مجموعة تداول – فوركس ، أسهم ، مؤشرات إلى أخره..

:تنبيه

يحمل هذا الموجز طابعاً إعلامياً و تعليمياً و تنشر بالمجان . تأتي معظم البيانات المدرجة في الموجز من المصادر العامة معترفة أكثر و أقل موثوقية . مع ذلك ، لا يوجد تأكيد على أن المعلومات المشارة إليها كاملة و دقيقة . لا يتم تحديث الموجز . معظم المعلومات في كل موجز ، تتضمن الرأي و المؤشرات و الرسوم البيانية و أي شيئ اخر وتقدم فقط لأغراض التعريف وليس المشورة المالية أو توصية . لا يمكن اعتبار النص باكماله أو أي جزء منه و أيضاً الرسوم البيانية كعرض لقيام بصفقة بأي اداة . آي إف سي ماركيتس وموظفيها ليست مسؤولة تحت أي ظرف من الظروف عن أي إجراء يتم اتخاذه من قبل شخص آخر أثناء أو بعد قراءة نظرة عامة .

الرابحون والخاسرون السابقون

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...