coffee Price LIVE CHART - coffee Price History

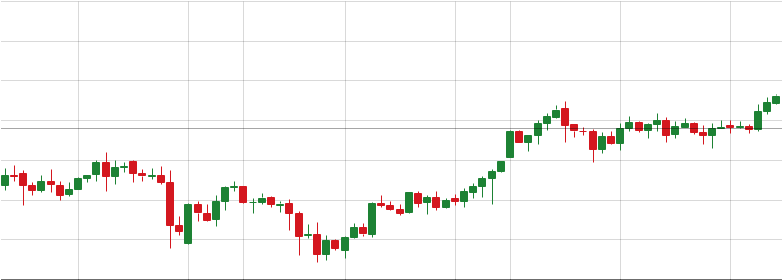

The coffee price today is $292.5300. On this page you can find complete information about coffee, including the current price and its change on the live chart, which can be viewed across 8 different time frames.

coffee Price Live

coffee today is an important piece of information for traders for several reasons.

The price of coffee is a key indicator of a commodity's supply and demand. By knowing the current price, traders can assess potential future price movements and make informed decisions about buying, selling, or holding their positions.

Tracking the coffee price over time allows traders to identify trends in the market. Is the price rising or falling? Understanding these trends can help traders predict future price movements and capitalize on profitable opportunities.

Commodity market is volatile, and prices can fluctuate significantly. Knowing the current price helps traders manage their risk by setting stop-loss orders and other risk management strategies.

coffee Price and Rate Today

Staying on top of the coffee price is crucial for traders in today's market. The coffee price serves as a benchmark for many commodity contracts, and knowing its current value allows traders to make informed decisions in two key ways:

- Measuring Market Value: by knowing the current coffee price, traders can assess the overall health of the market. A rising coffee price might indicate strong demand, while a falling price could suggest a surplus in supply. This understanding of market value helps traders make informed decisions about buying, selling, or holding their positions.

- Benchmarking Performance: many commodity contracts are priced relative to the coffee price. Having this information readily available allows traders to benchmark the performance of their investments and compare them to the overall market. This comparison helps traders identify opportunities and adjust their strategies accordingly.

How to Trade coffee

coffee, a major benchmark in the commodity market, offers various avenues for traders. Here are the steps of how you can enter the coffee trading arena:

1. Choose Your Platform

- Brokers: Partner with a reputable broker who provides access to exchanges where coffee futures contracts or CFDs are traded.

- Trading Platforms: Research and select a user-friendly trading platform offered by your chosen broker. These platforms allow you to place trades, monitor prices, and analyze market trends.

2. Understand the Instruments

- Futures Contracts: These lock you into an agreement to buy or sell a specific amount of commodity at a predetermined price by a set expiry date.

- CFDs: Contracts for Difference allow you to speculate on coffee price movements without physically owning it.

3. Develop a coffee Trading Strategy

- Fundamental Analysis: Evaluate factors like global economic conditions, geopolitical events, and supply-demand dynamics that impact commodity prices.

- Technical Analysis: Use technical indicators and chart patterns to identify potential entry and exit points for your trades.

4. Risk Management

- Start Small: Begin with smaller trade sizes to manage potential losses, especially if you're a new trader.

- Stop-Loss Orders: Implement stop-loss orders to automatically exit a trade if the price moves against you, limiting potential losses.

- Take-Profit Orders: Set take-profit orders to lock in gains when the price reaches your target level.

5. Stay Informed and Monitor Market News

Keep yourself updated on relevant coffee market news and events that can influence prices. Also consider insights from financial analysts and market experts to refine your trading decisions.

coffee Price Chart

- 1m

- 5m

- 15m

- 30m

- 1h

- 4h

- 1d

- 1w

FAQs

What is the current price of coffee?

As of Mar 7, Arabica coffee futures (ICE Coffee C) are trading at approximately $292.5300 per pound.

What time does the coffee market open?

Arabica coffee futures are primarily traded on the Intercontinental Exchange (ICE) and the CME Group. Trading hours can vary based on the exchange and contract type. For instance, ICE Coffee C futures are actively traded from 1:30 AM to 3:15 PM Central European Time (CET), Monday through Friday.

What are the main factors affecting the price of coffee?

Here are factors influence coffee prices:

- Weather Conditions: Adverse weather events, such as droughts or frosts, can damage crops and reduce supply.

- Tariffs and Trade Policies: Imposition of tariffs, like the 50% U.S. tariff on Brazilian coffee imports, can increase costs and affect supply chains.

- Currency Fluctuations: Changes in exchange rates, especially the Brazilian real against the U.S. dollar, can impact export competitiveness.

- Global Demand: Shifts in consumer preferences and consumption patterns influence demand.

- Supply Chain Disruptions: Logistical issues or labor strikes can hinder the movement of coffee beans from producers to markets.

Who regulates the coffee trade?

The coffee trade is regulated by:

- International Coffee Organization (ICO): An intergovernmental organization that coordinates international coffee agreements and promotes international cooperation.

- National Governments: Countries like the U.S. and Brazil have their own regulatory frameworks governing coffee production, export, and import.

- Commodity Exchanges: Exchanges like ICE and CME establish trading rules and standards for coffee futures contracts.

- National Coffee Boards: Entities such as the Kenya Coffee Producers and Traders Association oversee domestic coffee markets and auctions.

What are the largest coffee-Producing countries?

- Brazil – The world's largest producer, primarily of Arabica beans.

- Vietnam – Known for producing Robusta beans, mainly for instant coffee.

- Colombia – Famous for high-quality Arabica beans.

- Indonesia – Produces both Arabica and Robusta beans.

- Ethiopia – Considered the birthplace of coffee, with a rich variety of beans.

- Honduras – A significant producer in Central America.

- India – Produces both Arabica and Robusta beans.

- Peru – Known for organic coffee production.

- Uganda – Primarily produces Robusta beans.

- Mexico – Produces both Arabica and Robusta beans.

What are the biggest coffee companies?

- Nestlé – Owner of brands like Nescafé and Nespresso.

- Starbucks – A global coffeehouse chain with a significant retail presence.

- J.M. Smucker Company – Owner of brands like Folgers and Dunkin' coffee.

- Lavazza – An Italian manufacturer of coffee products.

- Kraft Heinz – Owner of brands like Maxwell House.

- Tchibo – A German chain of coffee retailers and cafés.

- Dunkin' Brands – Known for its Dunkin' Donuts coffee offerings.

Technical Analysis

Technical analysis is a method of studying and evaluating market dynamics based on the price history. Its main purpose is to forecast price dynamics of a financial instrument in future through technical analysis tools. Technical analysts use this method of market analysis to forecast the prices of different currencies and currency pairs. This type of the analysis will allow you to make market forecast based on studying historical prices of the trading instruments.

See also latest technical analysis of the price dynamics of #C_COFFEE Dollar: COFFEE forecast.